Buy Broadcom, Sell Lululemon: Stock Picks for This Week

This week brings significant market focus with key events including a potential Federal Reserve rate cut, notable labor data releases, and earnings reports from major companies. Analysts are particularly optimistic about Broadcom’s upcoming earnings, while Lululemon faces challenges that could impact its performance.

Key Events Impacting the Market

The Federal Reserve is anticipated to reduce interest rates by 25 basis points during its policy meeting on Wednesday. This move is likely influenced by recent inflation data and is expected to provide clarity on future monetary policy.

The Federal Open Market Committee (FOMC) will also unveil new economic projections for interest rates, unemployment, and inflation extending to 2026. Comments from Fed Chair Jerome Powell post-meeting could further influence market reactions.

Upcoming Labor Market Data

- JOLTS Job Openings Survey: Scheduled for release on Tuesday.

- Weekly Jobless Claims: Set for Thursday.

Stock Picks for the Week

In the current trading environment, an emphasis is placed on stock selections, particularly the recommendations to buy Broadcom and sell Lululemon.

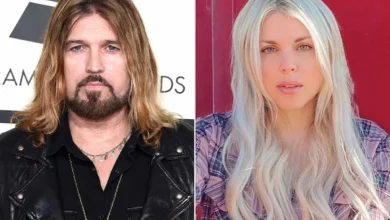

Broadcom: Buy Opportunity

Broadcom, a leader in the AI semiconductor market, is generating excitement as it approaches its fiscal Q4 earnings report scheduled for Thursday at 4:15 PM ET. Analysts predict a strong financial performance, with expected earnings of $1.87 per share. This marks a 31.7% increase compared to the previous year.

The revenue forecast stands at $17.45 billion, reflecting a significant year-over-year growth rate of 24.2%. The collaboration between Broadcom and Google, particularly highlighted by the recent launch of Gemini 3, enhances its competitive positioning within the AI sector.

Broadcom’s stock (AVGO) closed at $390.24, just shy of its record high of $403, indicating strong market interest. With multiple analysts upgrading forecasts and a high Financial Health Score of 3.13 from InvestingPro, Broadcom continues to stand out as a preferred investment.

Lululemon: Sell Considerations

Conversely, Lululemon’s upcoming Q3 fiscal 2025 earnings release scheduled for Thursday at 4:05 PM ET presents a less favorable outlook. Analysts expect adjusted earnings of $2.21 per share, reflecting a decline of 23% from the previous year. Revenue growth is projected at a modest 3.3% as competitive pressures mount.

The brand has faced significant downward revisions, with 22 analysts adjusting their earnings estimates negatively. Consumer demand is showing signs of weakness, especially in discretionary spending categories such as athleisure wear. This trend poses risks ahead of the holiday season.

Lululemon’s stock (LULU) closed at $190.01 amidst concerns of a potential earnings miss and deteriorating market position against competitors like Adidas and low-cost alternatives.

Conclusion

As the market prepares for pivotal events this week, Broadcom emerges as a bullish pick while Lululemon faces challenges that may impact its share price. Investors should stay informed and consider these recommendations as they navigate their trading strategies.